MARKET COMMENTARY

Markets come into the week riding another high. At last week’s FOMC meeting, the Federal Reserve gave markets plenty to chew on, which they then digested with relative ease. As expected, the Fed delivered the first interest rate cut of 2025, resuming its paused cutting cycle with a 25 basis point move. As usual, the more interesting part came afterward with Jerome Powell’s comments and a fresh Summary of Economic Projections from committee members. Adding to the drama, the committee welcomed a new member recently appointed by President Trump, who cast the lone dissenting vote in favor of a larger 50 basis point cut.

A key part of the picture the Jerome Powell painted last week relies on the balance of risks between their dual mandate: inflation and the labor market. He repeatedly noted that risks to the labor market have grown and justified this “risk management” cut to fall more in line with that balance. While Fed policy acts with long and variable lags so we wouldn’t see the impacts of such a small change in rates, Friday’s PCE inflation report could complicate the story. As discussed in last week’s chart of the week, if the uptick in inflation witnessed over the last few months adds another data point to the trend, the cuts currently baked in for the coming months will come into question. Bond markets have done some adjusting, with yields rising as traders dial back expectations for aggressive easing. With the economy still humming for now, investors may once again find themselves rethinking the familiar cycle of rate bets.

The boys are back in town. Looking under the hood of the equity market, leadership from big tech and the Mag 7 is returning after briefly letting other names shine. Breadth across the market remains healthy and smaller caps have shown real improvement, but mega caps appear to be taking back control. Their importance to a sustained move higher cannot be understated. As highlighted in our chart of the week, the Mag 7 is now as large as the smallest 433 names in the S&P 500, so having them lead would provide major fuel for the rally.

Newton Model Insights:

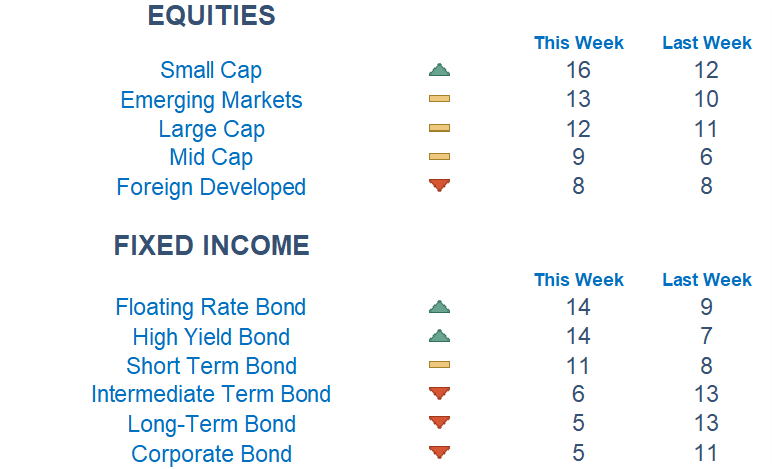

Our Newton Model continues to show strong momentum in small caps, which have steadily gained ground. US markets have pulled ahead of their developed market peers, while technology has reclaimed the top sector spot. The reversal in bond yields also shows up clearly in our models, with long bonds and investment-grade corporates seeing weaker scores.

Economic Releases This Week

Monday: None

Tuesday: S&P US Services PMI, S&P US Manufacturing PMI

Wednesday: New Home Sales

Thursday: Initial Jobless Claims, Existing Home Sales

Friday: August PCE, Consumer Sentiment

Stories to Start the Week

A proclamation from President Trump on Friday imposed a $100,000 fee on new H-1B visa applications

Berkshire Hathaway exited its extremely profitable stake in Chinese automobile manufacturer BYD, which it first started buying in 2008

European golfers are preparing for heckling at the Ryder Cup by wearing VR headsets that replicate the expected atmosphere

Pfizer is checking into the obesity drug game with a $7.3 billion deal to buy Metsera

Our Newton model attempts to determine the highest probability of future price direction by using advanced algorithmic and high-order mathematical techniques on the current market environment to identify trends in underlying security prices. The Newton model scores securities over multiple time periods on a scale of 0-20 with 0 being the worst and 20 being the best possible score.

Trend & level both matter. For example, a name that moves from an 18 to a 16 would signal a strong level yet slight exhaustion in the trend.

Technical trading models are mathematically driven based upon historical data and trends of domestic and foreign market trading activity, including various industry and sector trading statistics within such markets. Technical trading models, through mathematical algorithms, attempt to identify when markets are likely to increase or decrease and identify appropriate entry and exit points. The primary risk of technical trading models is that historical trends and past performance cannot predict future trends and there is no assurance that the mathematical algorithms employed are designed properly, updated with new data, and can accurately predict future market, industry and sector performance.

Comments are closed